1 out of every 11 adults in Bangladesh lack access to a bank account.

Across the world people living in poverty are disproportionately excluded from the formal financial system. They have to depend on informal means to manage their day-to-day expenditures, save, and borrow which is risky, unreliable and expensive.

Our customised and diverse range of products support families to access financial services, manage and build assets, invest in small enterprises, access employment opportunities and cope during emergencies. Complementing this, we build financial literacy and have instituted a range of client protection measures that distinguish us for our commitment towards client-centric service delivery.

IMPACT

11 million

clients

90%

of clients served are women

USD 6 billion

amount of loan disbursed in Bangladesh in 2023

*Rounding numbers

WHAT WE OFFER

Customised products designed to meet the needs of our diverse group of clients

Finance for small enterprises underserved by mainstream banks

Collateral free micro-loans given exclusively to women through women’s groups

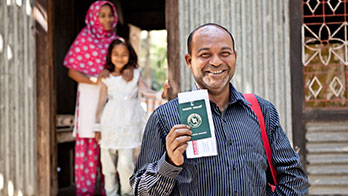

Supporting foreign employment opportunities and economic stability for migrant households

Loans exclusively for agriculture workers looking to invest on farming and increase their yield

Savings play a critical role in helping all families plan for the future, make investments, smooth spending, and cope with shocks

Loans for jobholders with low to moderate-income often unserved by mainstream financial institutions

Customised financial services for people living in the slums of Dhaka

Additional voluntary facilities to complement credit and savings

Enabling households to safeguard their finances and cope with immediate financial shocks in the event of a death of an earning family member

Savings and loan repayments through mobile money

Fully mobile-based branch offices in southeast Bangladesh

Pilot initiatives customised to serve specific purposes.

For households who need finance to cover medical treatment costs

Loans for farmers engaged in livestock rearing and specific types of seasonal agriculture

For clients seeking to improve their sanitation facilities

Reaching RMG workers with two types of financial services

HOW WE DO IT

Targeted design

Tailored financial services to meet the varying needs of people living in low-income communities.

Research and innovation

Continuous development and improvement of product offerings to meet emerging needs

Client protection and customer service

Delivery of responsible financial services in a way that protects clients’ rights

WHY IT WORKS

Financial solutions for everyone

Leveraging in-depth knowledge of our clients to develop products that meet a range of needs.

Financial sustainability

Developing sustainable financial products that ensure longevity and scale.

Accessibility

Convenient services available in all parts of the country.

SMART CERTIFICATION

We are the first organisation in Bangladesh, and the largest in the world, to be recognised with Smart Certification for upholding universal standards for client protection in microfinance, as determined by the Smart Campaign.

THE COST OF A PANDEMIC

COVID-19 is much more than a public health crisis in Bangladesh. With the economy coming to a standstill, people employed in the informal sector - nearly 80% of the total workforce - are being hit the hardest. BRAC microfinance is on the ground providing emergency financial services to the most vulnerable families. Read their stories here.

STORIES

VIDEOS

What is Financial Inclusion?

Financial Inclusion Week 2020 webinar on Consumer Protection

Inclusive insurance to protect low-income households